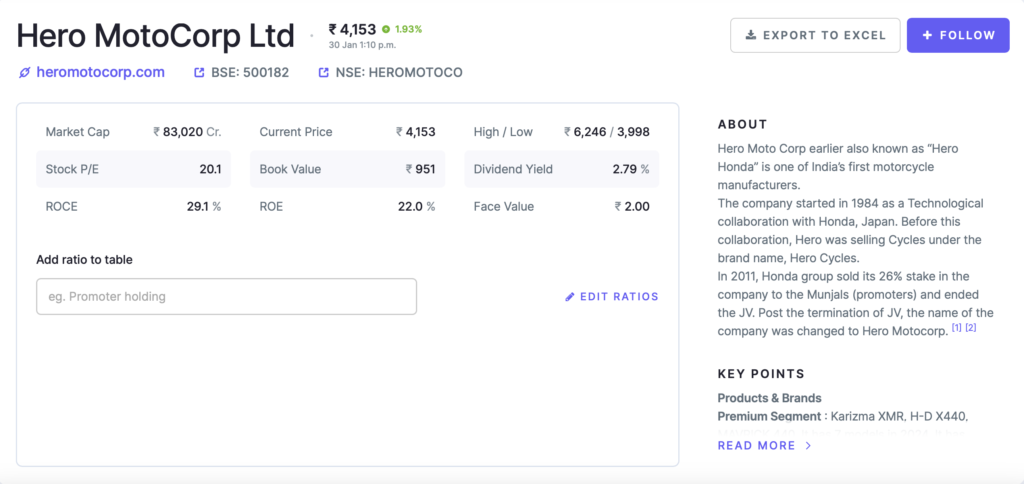

As of January 30, 2025, here’s an analysis of Hero MotoCorp’s financial and technical performance, along with expert recommendations based on the latest available data.

Financial Analysis of Hero MotoCorp:

- Profit Growth: In the fiscal year ending March 31, 2023, Hero MotoCorp reported a net profit of ₹27,999 million, marking a 20.2% increase from ₹23,291 million in the previous year. (equitymaster.com)

- Revenue Increase: The company’s revenue for FY23 stood at ₹347,274 million, up 15.3% from ₹301,063 million in FY22. (equitymaster.com)

- Profit Growth Over the Year: Hero MotoCorp reported a profit growth of 36.33% over the year, with the latest year’s profit at ₹3,967.96 crore compared to the previous year’s ₹2,910.58 crore. (ticker.finology.in)

- Recent Quarterly Performance: In the quarter ending September 30, 2024, the company achieved a standalone profit of ₹12.04 billion, a 14% year-on-year increase, driven by higher sales of mid-range motorcycles. (reuters.com)

Technical Analysis:

- Moving Averages: As of July 1, 2024, the 50-day simple moving average (SMA) was at ₹5,517.19, and the 200-day SMA was at ₹5,476.24, indicating a bullish trend as the short-term average was above the long-term average. (investing.com)

- Relative Strength Index (RSI): The 14-day RSI was 56.691, suggesting that the stock was neither overbought nor oversold at that time. (investing.com)

- Expert Technical Indicators: A comprehensive technical analysis, including indicators like MACD, Stochastic, and Moving Averages, is available for detailed insights. (moneycontrol.com)

Expert Recommendations:

- Analyst Insights: As of November 14, 2024, analysts noted that Hero MotoCorp’s growth was driven by increased sales of mid-range motorcycles and the launch of premium models like the “Karizma XMR.” The company plans to introduce more premium motorcycles and new scooters by March 2025, indicating a strategic focus on expanding its product portfolio. (reuters.com)

- Market Position: Hero MotoCorp maintained its position as India’s top two-wheeler maker, with a nearly 30% market share as of August 13, 2024. (reuters.com)

Investors are advised to monitor upcoming product launches and market expansion strategies, as these factors could influence the company’s future performance.

As of January 30, 2025, financial analysts have provided the following recommendations for Hero MotoCorp:

- Jefferies: Adjusted the price target to ₹5,500 from ₹5,800, maintaining a ‘Buy’ rating. (uk.marketscreener.com)

- Nomura: Increased the price target to ₹5,805 from ₹5,663, maintaining a ‘Buy’ rating. (uk.marketscreener.com)

Additionally, experts have included Hero MotoCorp among stocks to consider before the 2025 budget, anticipating potential income tax relief for the middle class, which could boost consumer spending. (livemint.com)

The consensus among analysts suggests a favorable outlook for Hero MotoCorp, with several maintaining ‘Buy‘ recommendations and setting price targets above the current market price.

Explore More :- Stockk.in

Leave a Reply